Wesley Financial Group Review 2020

Wesley Financial Group is one of the bigger more established timeshare exit firms.

Our in-depth review of Wesley Financial Group will help you know more about the company, how it operates and its pros and cons. Look no further if you want an honest assessment.

Don’t forget to check out our special ‘Timeshare Tracy Insider View’ right before the end!

Who is Wesley Financial Group?

Wesley Financial Group, or WFG for short is a timeshare exit company that offers services for those who desire to get out of their timeshare and its associated costs.

WFG started out in 2012 and boasts hundreds of employees spread out in several offices – Las Vegas in Nevada, plus Nashville and Franklin in Tennessee. In recent reports Wesley Financial Group has overseen an increase in processed timeshare cancellations, which means they have been taking on a lot of new clients.

Is that good or bad? Well the fact they are growing is probably positive and means they offer a valid solution that is having an impact in the market.

It also means they should be able to provide testimonials of people you can talk to before you accept their service.

Can You Trust Wesley Financial Group?

WFG is rated A+ by the Better Business Bureau on more than 50 5-star reviews and 323 reviews in total. This is a good indication that the company is legitimate and have good practices.

It’s worth noting that the firm has a Dun & Bradstreet rating that’s active, which goes to show that they have a high net worth. A high rating on this platform means they mostly keep their promise of getting their clients out of unwanted timeshare.

In November 2019, however, BBB suspended WFG of its accreditation due to ‘failure to uphold BBB’s Standard of Build Trust and Embody Integrity’.

This revocation remains in place for a period of at least one year, at which point it can be lifted.

Although the suspension does cast a cloud it’s encouraging to see that they continue to receive positive reviews on BBB. This suggests they are raising their standards in the face of a challenge and there is a fair change that the revocation may be lifted once a year has passed.

The Good Points

Wesley Financial Group has a well-designed personnel structure headed by charismatic leadership. Perhaps the company’s claim to fame is that their CEO Chuck McDowell fought Wyndham, a big whale of a timeshare company and won the lawsuit.

Wyndham sued Chuck McDowell and accused the CEO of divulging trade secrets when their customers wanted to cancel. The jury decided that he did not expose Wyndham’s trade secrets and was awarded the case.

When browsing through the WFG website you’ll be reminded of how their CEO https://timesharecancellations.com/about-chuck/ will fight for your cause at every turn, a positive sign.

Moreover, the site features videos of satisfied customers and a page dedicated to Trustpilot reviews and ratings. All content on the firm’s website conveys trust and a helpful partner who can get the job done.

There is a Tools page that explains in detail how maintenance fees inflate over time. You can add in details pertaining to your timeshare and get a graph of how it will affect you and your finances long-term.

While WFG does not offer escrow solutions, they offer 100% money back guarantee in-writing, something that’s rare in the timeshare exit industry. The company’s high net worth adds to the confidence, client-wise.

The firm claims that they work with 300-plus timeshare developers, so there’s a good chance that your timeshare could be from one of them.

This further confirms the reputation of the company as an advocate for timeshare owners who know what they are doing.

The Bad Points

WFG’s timeshare cancellation methods aren’t listed on their website, but what we do know is that the firm sends out letters to timeshare companies in behalf of their clients. However, we don’t know if attorneys are involved in the matter.

Ideally, you’d want to hire a firm that uses lawyers as they represent a legal aspect and add a layer of protection to your cancellation claims.

In this WFG blog post, they present themselves as a better option in a number of ways. You can try to discuss this with a WFG employee to have the matter clarified. They do have dozens of VPs, managers, qualification and resolution specialists in the WFG team as seen on their website.

As stated, WFG does not offer escrow solutions, another feature that can guarantee consumer safety.

While it’s true that they offer a 100% money back guarantee, this would be a non-factor if the firm ever decided to declare bankruptcy. For those who want to be sure, an escrow option is a must-have.

Wesley Financial Group is rather selective when it comes to timeshare owners. They’ll most likely work with you if the timeshare developer you’re with is under their coverage and if you meet other criteria.

This likely means they don’t just accept any case but will only work with families for whom they know they can deliver.

We notice that the website is lacking an FAQ page, something that can help first-timers understand their situation better before committing to a timeshare exit procedure. Aside from this it can also draw in those who may be on the fence and those who need a little more assurance.

WFG’s Timeshare Exit Costs

It’s normal for timeshare exit companies to not disclose any fees or costs associated with their service on the website. This is understandable – after all, different situations may call for different expenses, and timeshare resolution is a personalized service.

Timeshare exits vary depending on several factors, including mortgage balance, resort, the contract and others. The website refers you to contact information to get accurate quotes and to discuss your particular timeshare issue further.

The sentiment is echoed when browsing through online reviews. Historically, Wesley has charged depending on whether you still have a mortgage or if the timeshare has been paid off. Costs will vary.

After sifting through the reviews the costs of having Wesley take your timeshare exit case is often between $4,000 to $7,000, which is reasonable, though it may go higher depending on the complexity of the case. This is within range as we know some companies can charge $10,000 and above for timeshare cancellation.

That said, there’s still negotiating room for the final quote and you should ask for a lower price. Timeshare exit companies will want your business so they’ll consider it.

Wesley Financial Group Reviews

WFG has had a good run of positive reviews on BBB and Trustpilot, but was subsequently marred by the suspension in 2019.

Many reviews regarding WFG says that the company did a good job on timeshare cancellations. What stood out was the fact that some customers say that the firm honors its money back guarantee. In the absence of an escrow a guarantee may be more cost-effective but they aren’t expected to fulfill it either.

Before agreeing to a contract it’s best to get a copy of all that’s been discussed so you won’t have any problems later on.

Wesley Financial Group has a majority of good reviews across various websites on the internet. It has around 25 good reviews on Best Company a, 20-plus on Glassdoor averaging 4.9 stars, and 178 reviews on Google averaging 4.6 stars. On Trustpilot, the timeshare exit firm has 260-plus reviews with a 4.6 average rating. The most common statement was that WFG did what was asked, and this fosters trust for future clients. On Yelp, the firm has two 5-star reviews and one 2-star rating.

Here are some sample reviews:

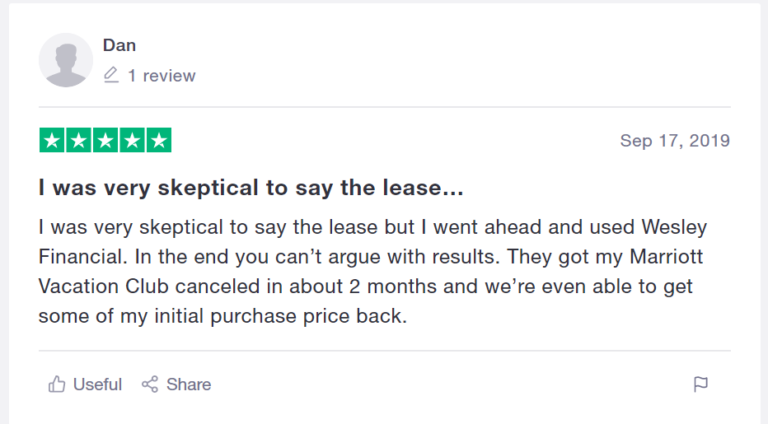

Wesley Client Review 1

A review that comes from a Marriott timeshare owner. Though a bit short, the review states that WFG was able to help him exit from his contract and even got his remaining money back from the developer. It’s rare that a company can persuade a timeshare to cancel the agreement, let alone hand over the remaining balance but it seemed that WFG was able to do it without too much trouble. The client stated that WFG was able to complete the task in two months.

Wesley Client Review 2

A different review and still a positive one. Ms. Wade said that WFG was able to have the timeshare contract ended without experiencing a ding on her credit report. For the uninitiated, timeshare firms will sometimes warn you that your credit may take a hit when the timeshare cancellation gets approved, but this wasn’t the case with Wesley Financial Group.

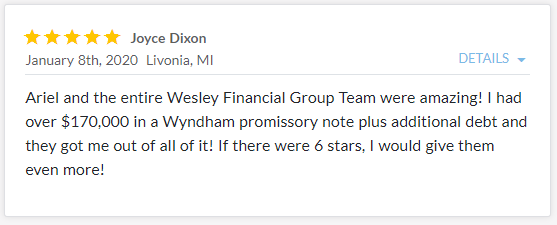

Wesley Client Review 3

A Best Company review which shares details such as a $170,000 balance and a timeshare on Wyndham. The results were good and the customer was able to save a huge amount of money.

Wesley Client Review 4

Next up is a negative review that was posted on BBB. The complaint was due to ‘problems with service’, to which WFG had a response. Furthermore, the firm spokesman mentioned that they have spoken with Mr. Wiley and had reached a satisfactory resolution. To date, the BBB complaints total to 18 over the past 3 years, with 13 of them now closed.

Video Reviews

Some of the Wesley Financial Group reviews come in video form and is a sort of achievement for that company. There are two links shown here:

These videos found on the official WFG site appear to be professionally edited with their branding.

Recent videos from Jim S and Brandon B on the WFG FB page look more like they were made by customers. It’s stated on one of the posts that they ask clients to leave a video testimonial once they complete the cancellation process.

Social Media Presence

Wesley Financial Group LLC is active on popular social media channels, where you can view more videos of client testimonials and regular updates on the number of relieved timeshares.

We regard social media activity as a trust indicator because it suggests the company is visible and available to its stakeholders and clients and intends to be around a long time.

Timeshare Tracy Insider View

We have connected hundreds of timeshare owners to Wesley and over time have gotten to know their process and also their executive team.

What stands out to us is their confidence in their service and genuine desire to help timeshare owners. Maybe because of Chuck McDowell’s personal experience – the whole company is mobilized and motivated around the mission of getting people out of their timeshares.

They seem to have a mentality of wanting to do right by their clients and doing whatever it takes to get the job done.

They are also very much a family business and their reputation is important to them. We have spoken to different family members who are in key positions within their firm. This suggests they want to build a long-term legacy around their services.

Conclusion

The timeshare exit industry is a minefield and it can be hard to find a reputable firm to help you out.

Wesley Financial Group generally generally has a positive record in terms of reviews. The occasional negative review demonstrates authenticity and is a sign of a legitimate timeshare exit company. Their most recent negative review was on April 2020 but it’s been resolved since.

The ‘customer first’ maxim applies to the group, which translates into positive reviews on Trustpilot.

Our biggest gripe was that WFG doesn’t seem to call on the help of attorneys when sending a request to cancel. Second, they don’t offer an escrow option, but all things considered you get the services of a reputable company.

We’d normally advise timeshare owners to work on escrow as it encourages action from the firm. If possible, get one that has zero upfront payment and will only accept cash once your timeshare contract has been successfully canceled.

With WFG the escrow aspect is somewhat mitigated by the high Dun & Bradstreet rating.

Wesley Financial Group is not a fly-by-night firm and seem to be in the business for the long term. Their high net worth and financial profile should underwrite the value of their money back guarantee in case they are unable to accomplish the resolution promised. As such, we can say that you can safely do business with WFG if you want to cancel your timeshare contract.

Be Introduced to Wesley Financial by Tracy

Considering contacting Wesley Financial?

As a referral and recommendation service, Timeshare Tracy is uniquely placed to introduce you.

You can contact them directly. Or you can go through Tracy in which case we’ll offer you the following benefits:

• Special VIP Treatment and Follow-Up. Timeshare cancellation firms know we can pick and choose whom we send our readers to. So they know to treat our followers right!

• Opportunity to Request Alternative Quotations. We don’t care if you use Firm A, Firm B, or do it yourself. We only want you to achieve your goals, whatever it takes! So if your initial consultation is not to your liking we’ll help you find an alternative solution.

• Free Gift. As a small token of our gratitude for trusting us, we’ll send you an Amazon Gift Voucher worth $20 – for each appointment you show up for with a recommended Tracy partner introduced via introductions@timesharetracy.com. Terms and Conditions apply.

There is no obligation at all to continue once you are introduced and this is a free service

The benefit of going through us, in a nutshell?

The timeshare exit company will be on their toes because they’ll know that as a Timeshare Tracy user you have other options. We got your back!

For further information apply via email to introductions@timesharetracy.com.